Delivery drivers: are you really covered by your car insurance while you’re working?

The “sharing economy” has made it so much easier for just about anyone to pick up some extra income on the side. First it was Airbnb, which allowed people to rent out space in their homes and apartments. Then came Uber, allowing people with cars to become impromptu taxi drivers. And soon thereafter came the rise of delivery apps, including such well-known names as UberEats, DoorDash, GrubHub, and Instacart.

Delivery apps allow just about anyone to spend a few hours getting paid to use their own vehicle to deliver restaurant meals, groceries, and lots of other products, to consumers who for one reason or another don’t want to go out and pick up these items themselves. The popularity of these apps had been growing for several years, but 2020 has pushed them to the top of the heap, thanks to one very particular reason: Covid-19.

Indeed, with the virus making many people extremely fearful of going out in public, or at the very least aware that going shopping at the supermarket or picking up sandwiches at the deli could present a meaningful risk, delivery services suddenly became as much a necessity as a luxury. And as the number of customers has grown, so has the number of part-time delivery people.

At a time when many people have lost their jobs and are in need of a new source of income, the opportunity to work in the “gig economy” as a delivery driver has been a godsend for them. These are often people who never imagined they would be doing this type of work, but they have quickly slid right into it without giving much thought to what they are doing. They just know that they are replacing part or all of whatever income they may have lost due to Covid-19.

And they all lived happily ever after. The End.

But Wait, There’s More to the Story

If only things were that simple in the real world. But of course they’re not.

If you use your own vehicle to make deliveries, you could be taking on a massive risk without realizing it. Of course you have insurance for your car or motorbike. But are you sure your insurance is valid if you’re using the vehicle for deliveries?

If your answer is anything like, “I assume it’s valid,” or “Why wouldn’t it be, the car is insured for me driving it, and that’s all I’m really doing,” then you need to stop what you are doing right this moment and get a clear answer from your insurance company and your delivery company(s), immediately. You would be well advised not to make another delivery until you do.

The coverage landscape is like Swiss cheese, with holes all over the place, depending on which insurance company you have, and also which delivery service(s) you work for. Some personal car insurance policies cover you for deliveries with nothing additional required; others may offer additional riders or commercial add-ons; while still others may indicate that you are absolutely not covered while doing deliveries.

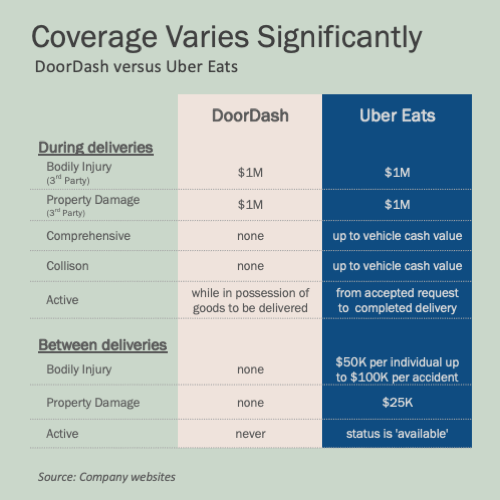

In addition, the different delivery companies offer differing amounts of coverage that augment your own insurance. Hence you can’t assume that each company gives you the same protection (and we know that some people deliver on behalf of more than one company), nor that because the company offers certain protections, you have nothing to worry about.

Your Car Insurance

The simplest case is if your personal car insurance policy provides coverage if you make deliveries on a very limited basis as a side hustle. However, this may not cover liability if you are in an accident and the delivery business is sued instead of the driver. If you’re working for one of the major companies like UberEats or DoorDash, your employer almost certainly has business liability insurance to provide this protection. But if you are a small business owner making your own deliveries, such as if you own a catering company, you need to get appropriate business insurance.

On the other hand, some personal car insurers simply will not cover you while you are working as a delivery person, meaning that as soon as you “clock in,” your insurance policy “clocks off,” and you are effectively fully exposed. If you are involved in any kind of incident or accident, all the liability falls directly on you. This is exactly the situation you cannot and must not allow yourself to be in. One false move, even if it’s not your fault, could result in you losing everything you have.

Talk to your insurance company and find out exactly what their policy is on delivery. It’s even better if you can get it in writing, which may involve the company representative pointing you to a specific place on their website. In many cases the company will inform you that you are not covered while making deliveries, but that they offer extra coverage that will cover you, in the form of riders or add-on policies that you can purchase.

If your personal insurance policy does not cover you while you’re making deliveries, and they don’t offer additional coverage for purchase, you may be able to purchase the additional coverage from another company that offers this specialized policy without being the primary insurer. But it may just be easier to look for a different insurer that will offer you both standard personal car insurance and the extra coverage you need for making deliveries.

Adding one more complication to the situation, you also need to clarify if your personal policy covers you if you use your car primarily for business driving, as opposed to personal driving. If the majority of the miles you drive is delivery-related, you very likely need to have a separate commercial policy, because in the eyes of insurers, your car has ceased to be for personal use and has become a business vehicle.

Coverage Provided by the Delivery Company

As we stated above, each delivery service provides different coverage for its drivers. The first step for you is to read about what is provided for you on the company’s website or in the documents you may have received when you signed on as a driver. But to gain a fuller understanding it’s probably a good idea to have a conversation with someone at the company who is authorized to explain exactly what the company covers and what it expects you to have coverage for on your own.

Be tenacious. Don’t stop asking questions until you are 100% clear on where you stand. Remember, it’s your car, your health, and your financial assets on the line, so it’s your responsibility to figure out everything you need to know.

As an example, a simple search of DoorDash’s website reveals that the company has a commercial auto insurance policy that covers drivers for up to $1 million in bodily injury and/or property damage to third parties arising out of accidents while on an active delivery. To qualify as “on an active delivery” you must be in possession of the goods to be delivered.

Note that this means the policy does not cover you once the goods have been delivered and you are returning to pick up more food for delivery, because during these periods you are not deemed to be “delivering.” Furthermore, the company’s coverage kicks in after you have exhausted your own car insurance, and it does not cover damage to your own car.

On this note, DoorDash states that while doing business as an independent contractor delivering for them, you are required to maintain your own insurance as required by law which includes, but is not limited to, an auto insurance policy. If you fail to maintain your own insurance, DoorDash's coverage may not apply at all.

UberEats’ coverage is similar but not the same. The company offers $1 million of commercial auto liability insurance per incident. The driver’s liability to third parties is insured from the moment a driver accepts the delivery request to the time the delivery is complete. In addition, as long as drivers carry comprehensive and collision coverage on their personal car insurance, Uber’s insurance will kick in and cover physical damage to their vehicle up to its actual cash value, regardless of who is at fault.

UberEats offers $50,000/$100,000/$25,000 of commercial auto liability insurance between deliveries. This means that during periods when a driver is “available” but between deliveries, if the driver’s personal policy doesn’t provide coverage, Uber’s policy insures the driver’s liability for bodily injury up to $50,000 for each individual, with a total of $100,000 per accident and up to $25,000 for property damage.

It’s Up to You, But it Doesn’t Have to Be Overly Painful

We get it, this stuff seems pretty daunting. You just wanted to earn some extra cash to help out with your family’s expenses during a tough time in the economy. Some people have even described what you’re doing and the valuable service you’ve been providing to people at high risk for contracting Covid-19 as heroic. Now suddenly you get the sense that you’re exposed to massive risk unless you become an insurance expert (which may be the last thing you have any interest in doing!)

Please don’t despair too heavily. We certainly don’t want you to bury your head in the sand and ignore this subject. There’s simply too much at risk for that to be an option. Our primary goal in this article is to make you aware that this is a subject you need to address and gain clarity on. But with the wide variations between insurers and delivery companies, we can’t possibly give particulars for every driver. Fortunately there are two very straightforward steps that should get you very close or all the way to the knowledge you need for your personal situation.

First talk to the delivery company and ask for their guidance on what coverage they offer, what gaps that coverage leaves, and what personal coverage they require and/or recommend you have. Next take that information and have a conversation with your insurance company and see what their policy is on their insured parties working as delivery drivers (either part time or full time, depending on how much of your driving is for deliveries.)

At that point you should have a much better picture of what you need, how well you are covered, and whether you need to take any actions. If your insurance company leaves you with gaps in protecting yourself, do not hesitate to talk to several others and specifically address the delivery question to see if they may be able to provide you with what your current insurer cannot.

You may not ever become an expert in insurance, but you can accomplish what you need to by being prepared with the basic information provided in this article when you talk to the insurance experts who are there to help you. Remember, no one cares about your life and your family as much as you do. So it’s important that you take the initiative to get the experts working for you, and that you put yourself in a position to evaluate the information you get from them.

Take action on this issue today, so you can get back to earning extra money in peace!